DECENTRALIZED CRYPTO EXCHANGESLUNG PROTOCOL EXCHANGEMETAMONSTAS 交易所

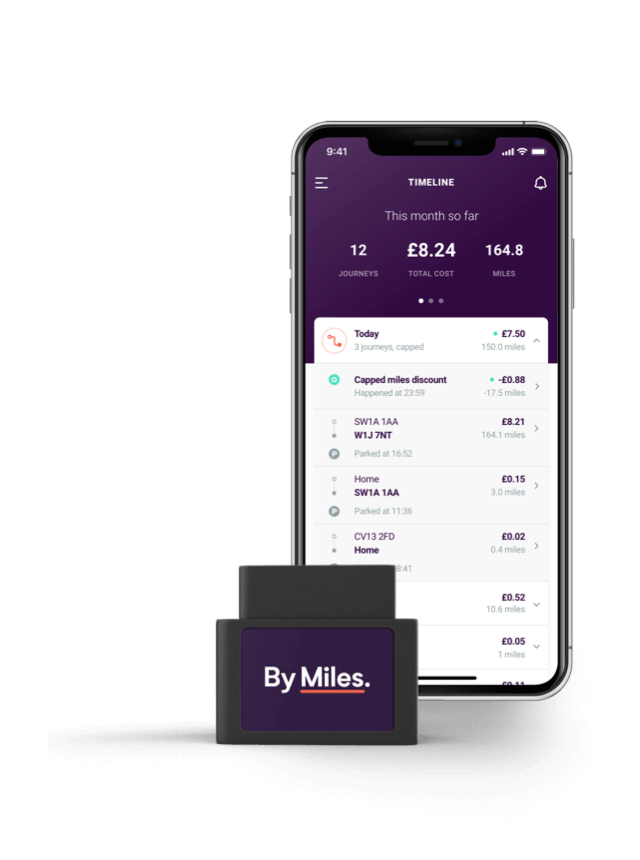

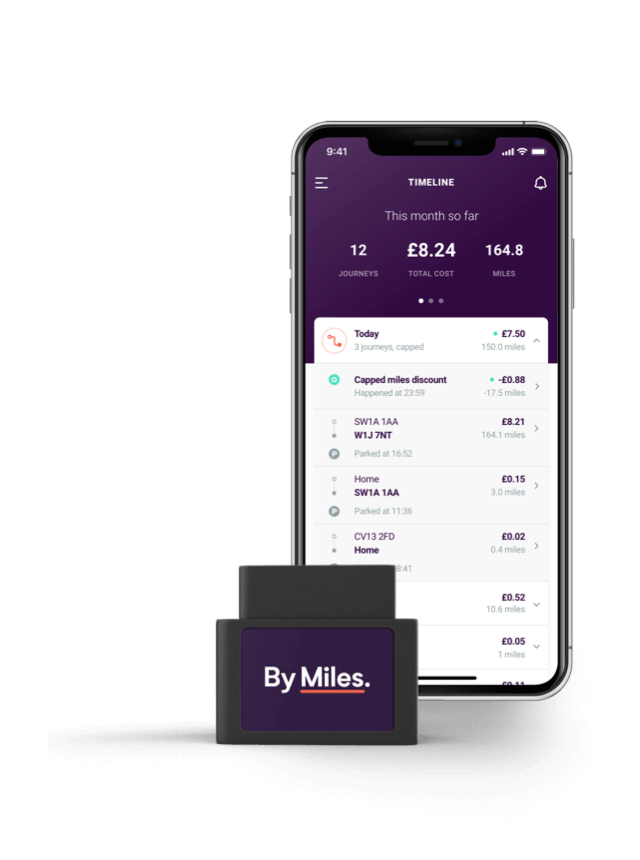

Simple, straightforward car insurance that you pay by the mile.

MSHLD EXCHANGE

why?

FCR APP

WORLD OF REWARDS EXCHANGES

Pay for what you use and always be covered by fully comprehensive insurance. No Claims Bonus protection comes as standard.

KCB EXCHANGE

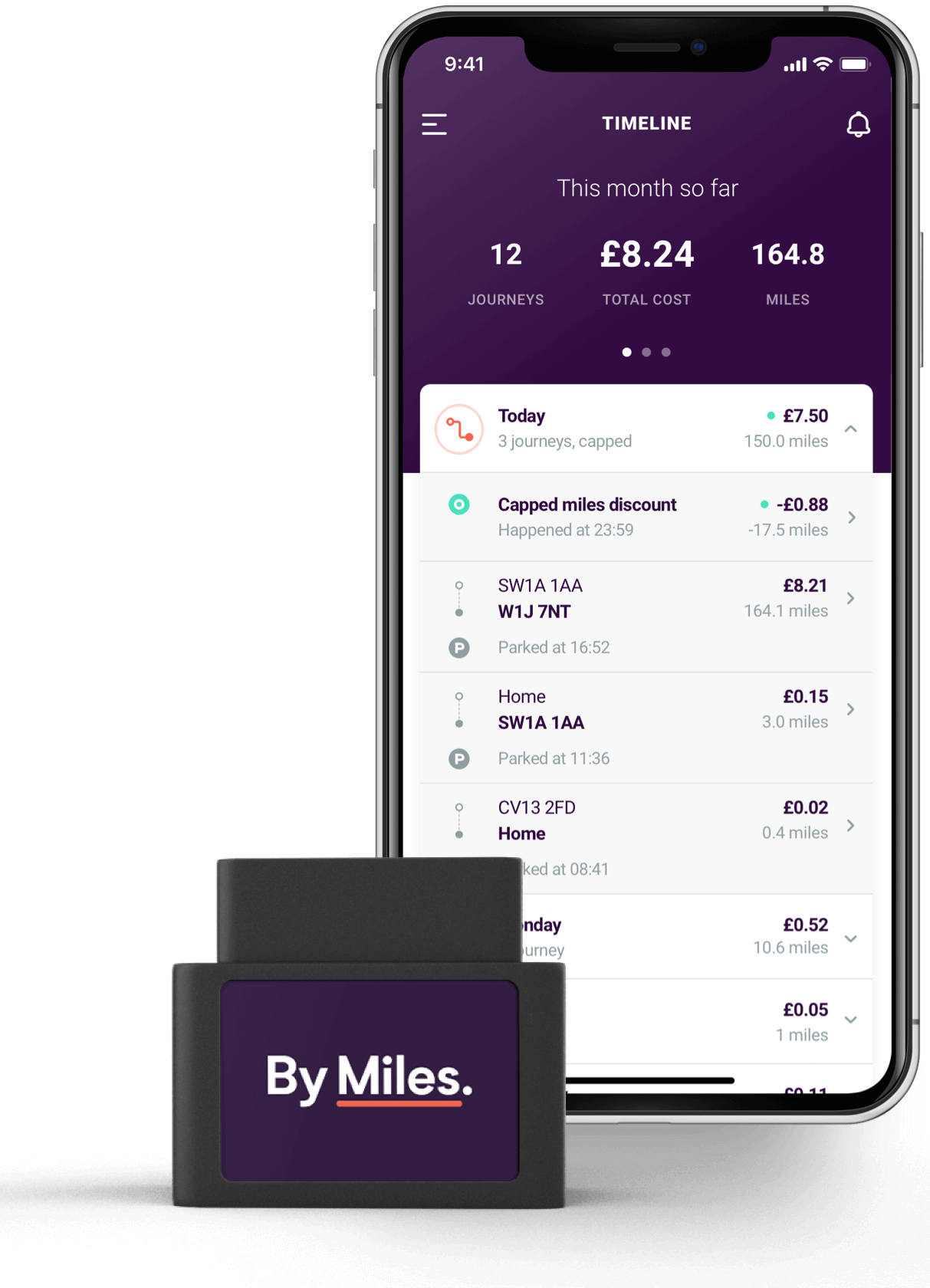

Instantly see the exact cost of each day’s driving in our app, then pay for what you’ve driven monthly. Simple as that.

SOLS EXCHANGE

Stay in complete control with simple bills, reminders and features to help you take care of your car on a daily basis.

CROSS CHAIN BRIDGE EXCHANGES

Pay for what you use and always be covered by fully comprehensive insurance. No Claims Bonus protection comes as standard.

NEWTOWN GAMING EXCHANGE

Instantly see the exact cost of each day’s driving in our app, then pay for what you’ve driven monthly. Simple as that.

ARC KYF VOTING 交易所

Stay in complete control with simple bills, reminders and features to help you take care of your car on a daily basis.

FANFFLE 交易所

It’s up to you. Either plug in our matchbox-sized Miles Tracker, or for newer cars, you can connect us directly with your car’s mileometer. It couldn’t be simpler.

Start a policy and your car’s covered by your fixed annual cost while it’s parked, then you get your own unique per-mile rate to cover your driving.

We send you a Miles Tracker in the post to measure the miles you drive. You can plug this under your car’s dashboard in moments.

Download our app or use our online dashboard to automatically see the cost of your journeys and access handy driving tools and reminders.

ALPHACAT EXCHANGE

It shouldn’t take a whole lunch break to get a car insurance quote. We’ll give you a basic idea of your price in under a minute.

Start your quick quote.

My number plate is

MSTR 交易所

CIA LOGIN

Become a By Miles member and you get much more than just an insurance policy.

You’re in control.

See the cost of the miles you’ve driven each day, right down to the last penny. Keep track of your monthly budget, plan for fuel costs and work out the cost of future trips.

Added extras for free.

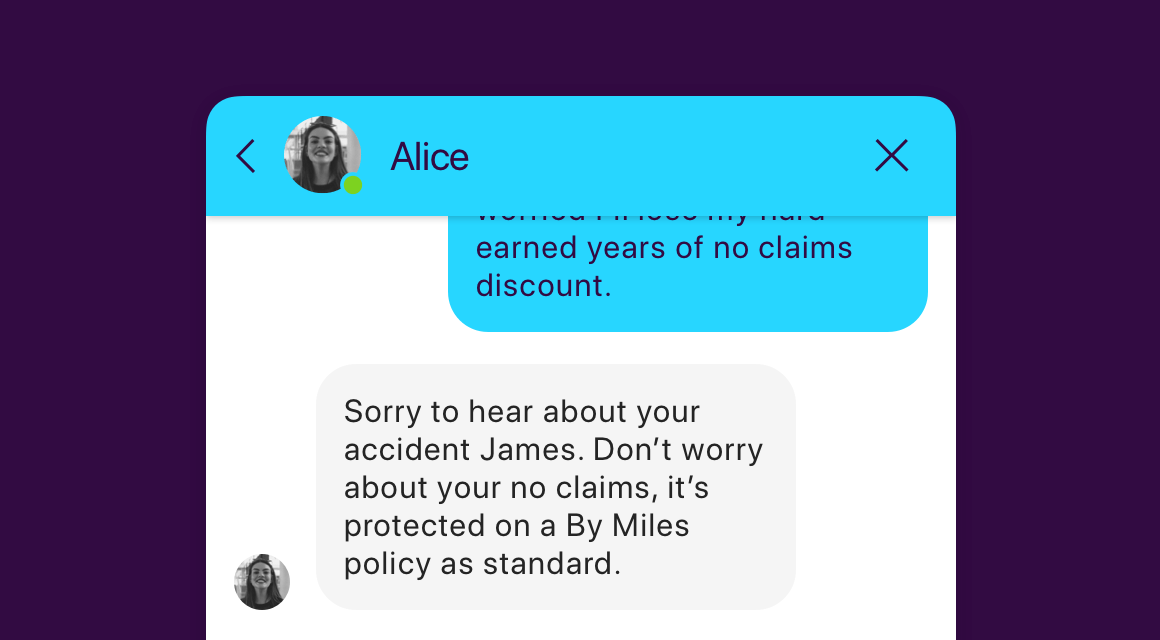

Unlike some insurers, we won’t charge you extra for No Claims Discount protection – you get it as part of every policy at no extra cost.

Capped mileage costs.

Sometimes you need to drive further than usual. We get that. We’ll stop charging you for the day’s miles if you clock up more than 150.

Award-winning customer service.

We’re not just a claims department, we’re with you every mile of the way. Use the app to contact our friendly support team on live chat when you need a hand.

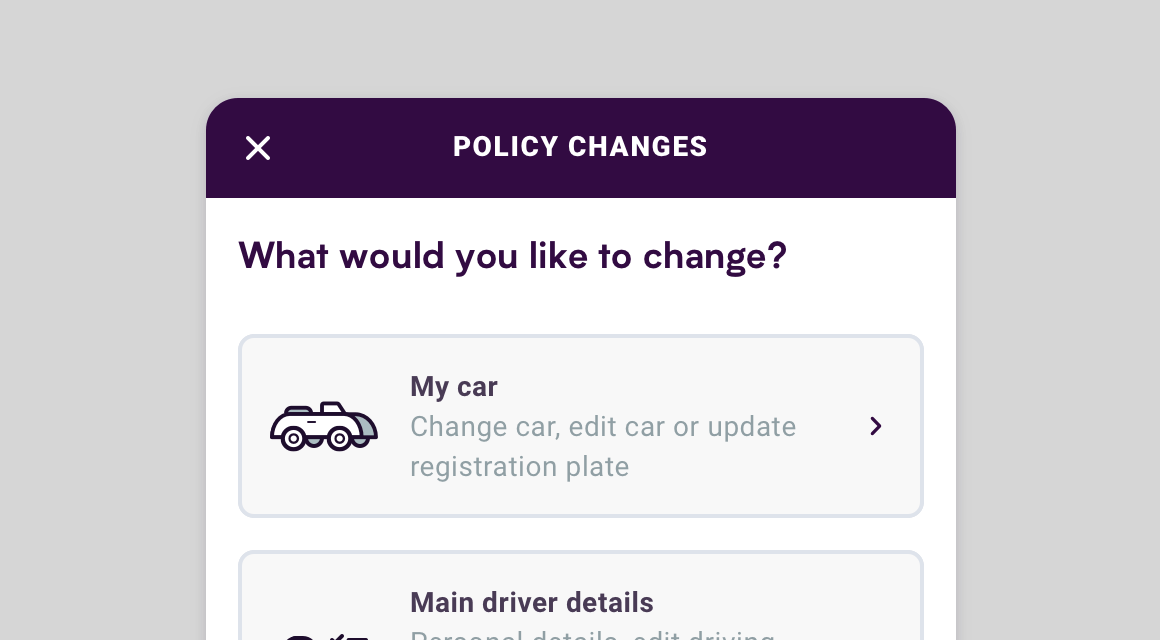

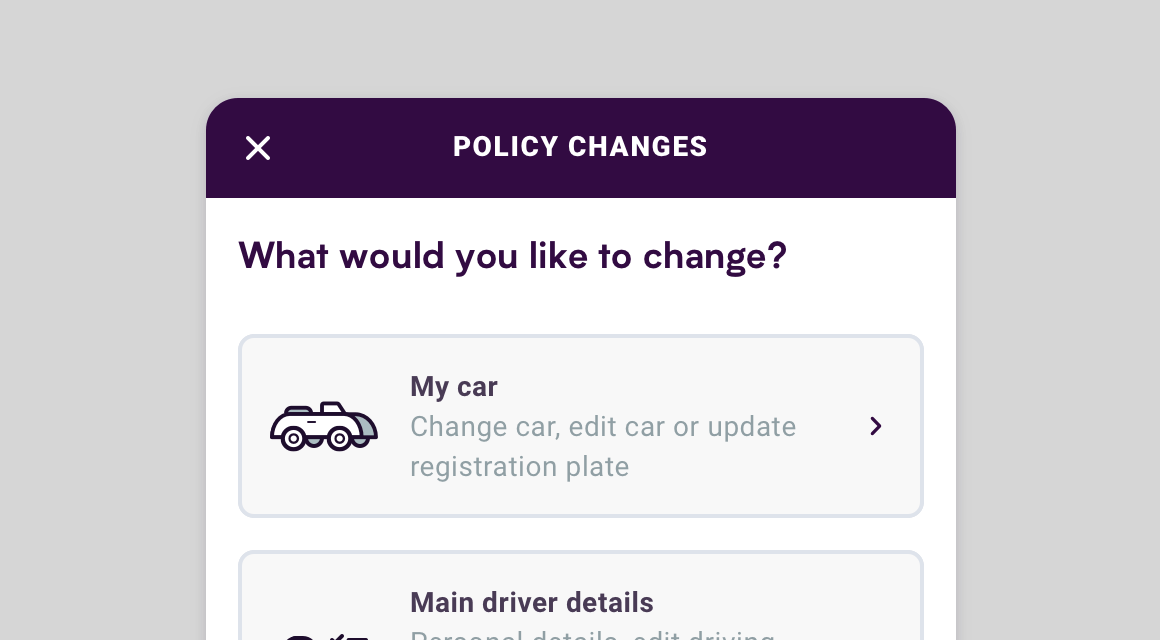

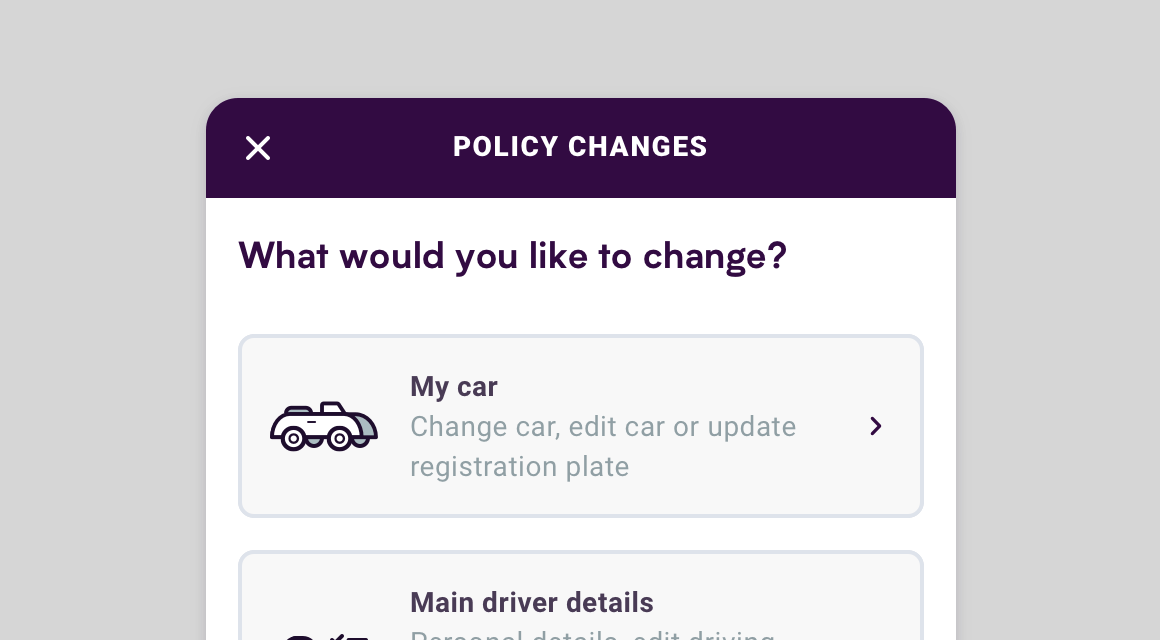

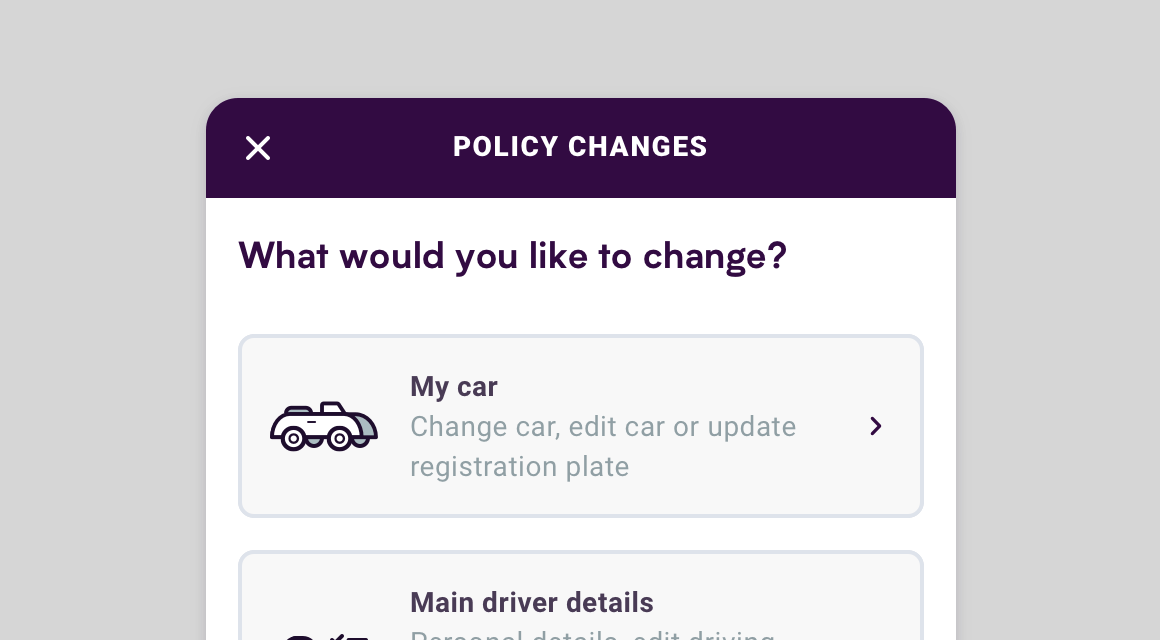

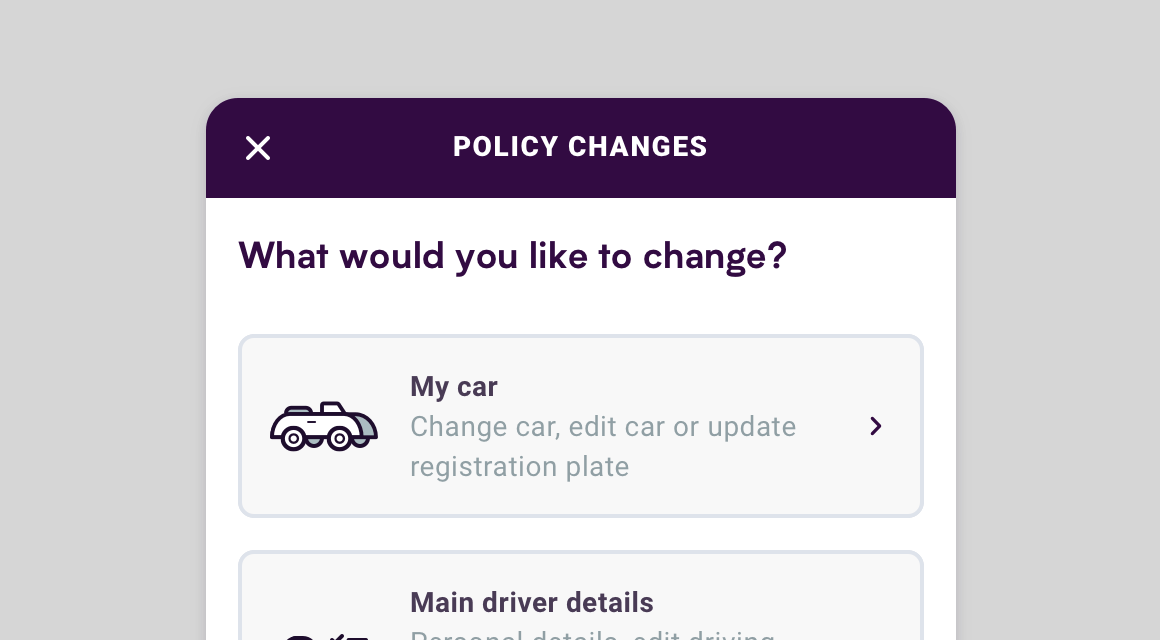

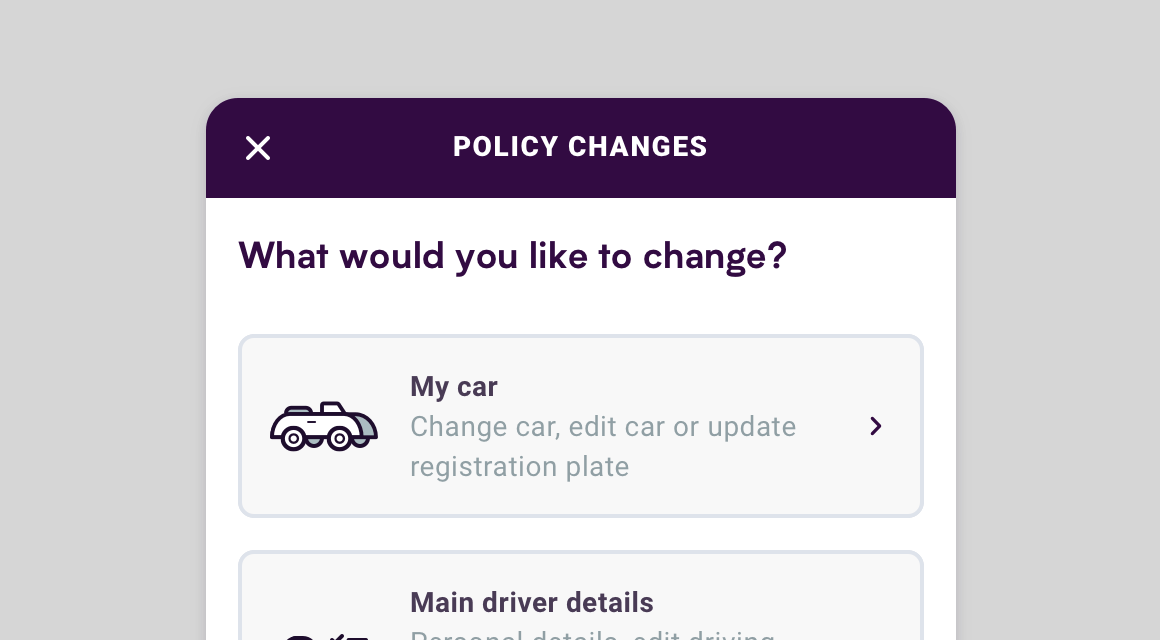

Instant self-serve policy changes.

Need to make a policy change quickly? No problem, you can do it yourself in the app. And there’s no admin fee for your first three changes each year.

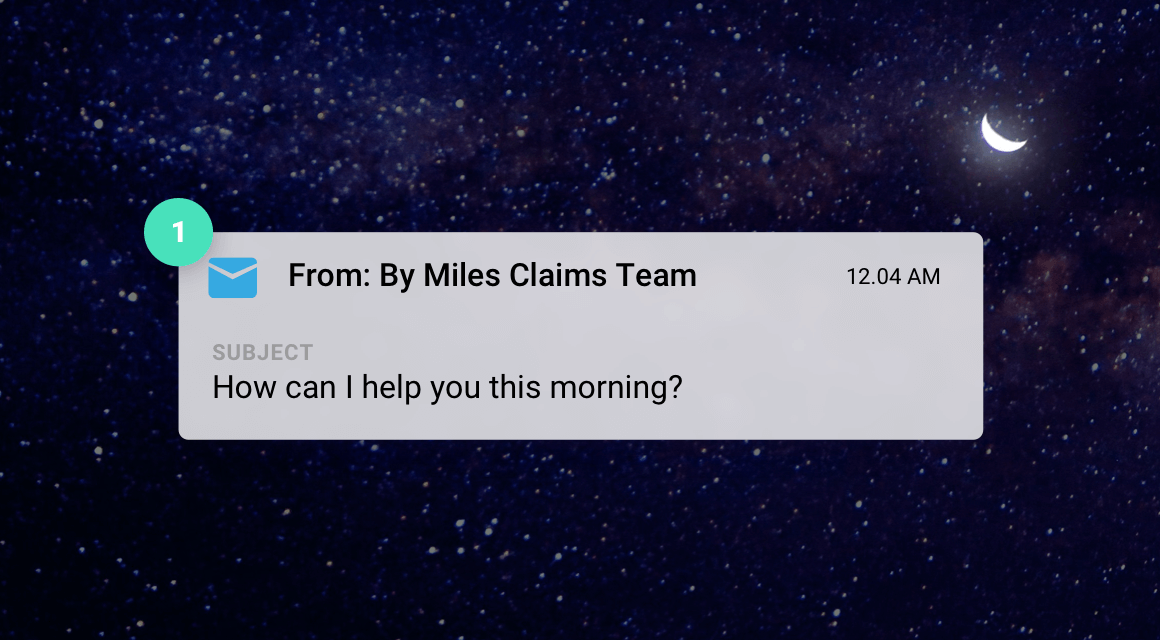

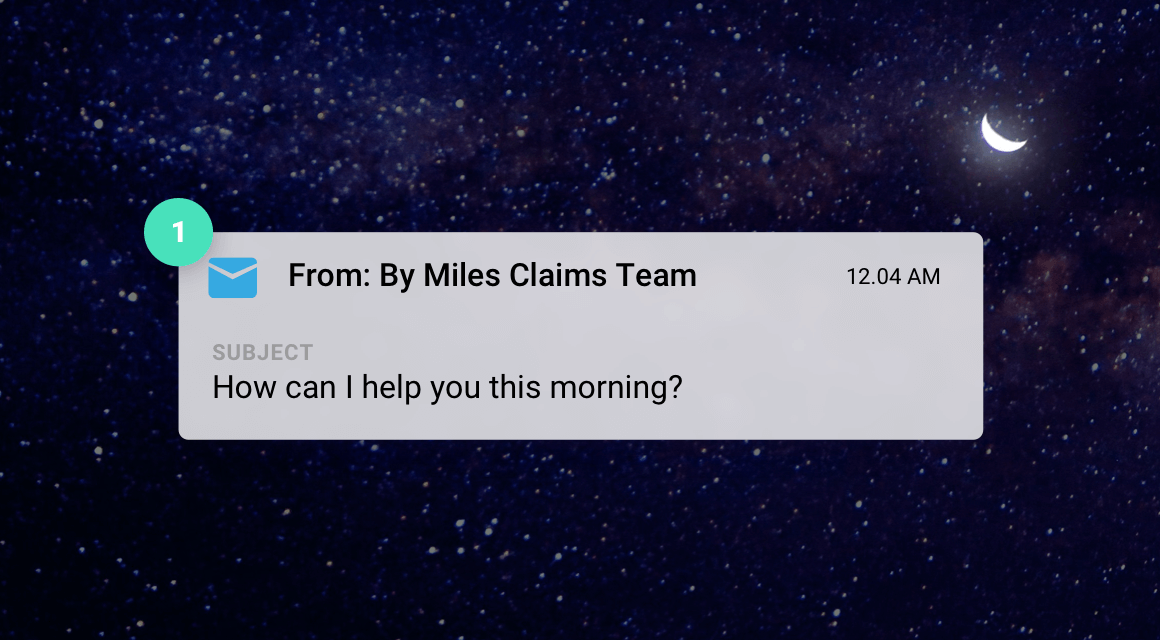

24-hour claims line.

Our award-winning, UK based claims team are there for you 365 days a year if the worst happens. Depending on your car, we may even be able to help track it down if it’s stolen.

You’re in control.

See the cost of the miles you’ve driven each day, right down to the last penny. Keep track of your monthly budget, plan for fuel costs and work out the cost of future trips.

Added extras for free.

Unlike some insurers, we won’t charge you extra for No Claims Discount protection – you get it as part of every policy at no extra cost.

Capped mileage costs.

Sometimes you need to drive further than usual. We get that. We’ll stop charging you for the day’s miles if you clock up more than 150.

Award-winning customer service.

We’re not just a claims department, we’re with you every mile of the way. Use the app to contact our friendly support team on live chat when you need a hand.

Instant self-serve policy changes.

Need to make a policy change quickly? No problem, you can do it yourself in the app. And there’s no admin fee for your first three changes each year.

24-hour claims line.

Our award-winning, UK based claims team are there for you 365 days a year if the worst happens. Depending on your car, we may even be able to help track it down if it’s stolen.

PORTAL 交易所SFC EXCHANGECHAINBING LOGIN

NODE RANDOM

-

Fully comprehensive policy, rated 'Excellent' on Trustpilot

-

Underwritten by an experienced panel of insurers

-

Authorised and regulated by the Financial Conduct Authority (FCA)

-

Data security certified to ISO 27001 standard

CURIOSITY FINANCE EXCHANGES

Still want more information about how our insurance works? For more information about how our policies might be able to help you save money, click on some of the frequently asked questions below:

ZENITH WALLET EXCHANGE

If you don’t drive often, we like to think that the way we calculate insurance premiums is fairer and more cost-effective than traditional car insurance.

Our policies are designed to save you money if, like many people in the UK, you drive under 7,000 miles a year. The simplest way to find out if it could work for you is to get a quick quote. Answer a few simple questions and you’ll get an estimate in less than a minute.

With us you pay a fixed yearly fee upfront to cover your car against theft, vandalism and accidental damage while it’s parked. After that, it’s pay as you go. Just pay for each mile you drive and you’re billed for what youe used monthly.

GAME TOURNAMENT TROPHY APP

If you don’t drive much then traditional motor insurance might not offer you the best rate, and you could end up subsidising the cost of motor insurance for higher mileage drivers.

We believe our policies are fairer – we charge a simple upfront cost to cover your car while it’s parked, after that we only charge you for the miles you drive. This means the less you drive, the less you pay.

Also, unlike traditional insurers, you can make up to three mid-term adjustments per year absolutely free of charge.

SHIBA V PEPE EXCHANGES

Taking out a policy is simple. When you get a new quote or a renewal quote, you’ll see two parts to the cost:

- A fixed annual fee that covers your car when it’s not being driven

- Your per-mile rate, this is normally just a few pence that we charge you for each mile you drive

When you get a quote, we’ll show you your total estimated cost based on your estimated mileage for the year. This is just an idea of what you’ll pay over the course of the year, as it’s a flexible, pay-as-you-drive policy it depends on how much you drive.

When you take out a policy, we’ll send you the Miles Tracker which you can quickly plug into your car yourself.

Once plugged in, it will connect and activate automatically. If you’re driving this will happen during the trip, and if you’re parked you can lock the car and leave it to it.

It may take up to 20 minutes for the Miles Tracker to activate for the first time, but once this shows up in your app or web dashboard you’re good to go. You don’t have to worry about doing it ever again!

Use the By Miles smartphone app or log into our web dashboard at dashboard.bymiles.co.uk. Depending on whether you’ve got a policy with a Miles Tracker or a totally trackerless one (for your connected car) you’ll automatically be able to see your individual journey costs or daily mileage, and access handy tools and control free reminders for things like your MOT or car tax.

BABYKASPA EXCHANGE

If your car’s just sitting there parked up, it stands to reason that you’re less likely to have an accident.

And if you don’t drive that much, you could be paying too much for your motor insurance.

Pay-per-mile insurance (also known as pay-as-you go, pay-by-mile or usage based insurance) isn’t for everyone, but if you drive under 7,000 miles a year then it could work for you.

Just visit our quote page to find out your fixed yearly fee to cover your car while it’s parked up and the tailored per-mile rate you’ll pay for each month for the miles you drive.

We’ll show you a clear breakdown of the costs, including your estimated cost for the year (based on your estimated annual mileage).

PAYT EXCHANGE

Normal insurers find it difficult to track how much you drive and will often assume you’ll drive more miles than you’ve told them.

You might tell your insurer you drive 5,000 miles rather than 10,000 miles, but that big difference can have little impact on the cost of your insurance.

At By Miles, we accurately track your mileage so if you drive less, you actually pay less.

PEPEGPT EXCHANGES

PLSA 交易所

We think a pay-by-mile policy is a fairer way to price motor insurance premiums. It can also work out much more cost effective as it gives drivers more control over their spending. The less you drive, the less you pay.

DSLA EXCHANGE

Your No Claims Bonus is precious, we get that. With every policy, we include protection of your NCD as standard. That means you’ll never lose any years of No Claims, even if you make a claim with us.

MIDAI LOGIN

There’s no cap on your mileage and we know you may need to drive a longer trip every now and then. That’s why your daily mileage costs are capped at 150 miles.

If you drive more than 150 miles in a day, that’s just fine. We just won’t charge you for your mileage if you drive more than that.

Likewise, we’ll never charge you for more than 10,000 miles in a year either, no matter how far you drive over the 12 months you have your policy.

CLION APP

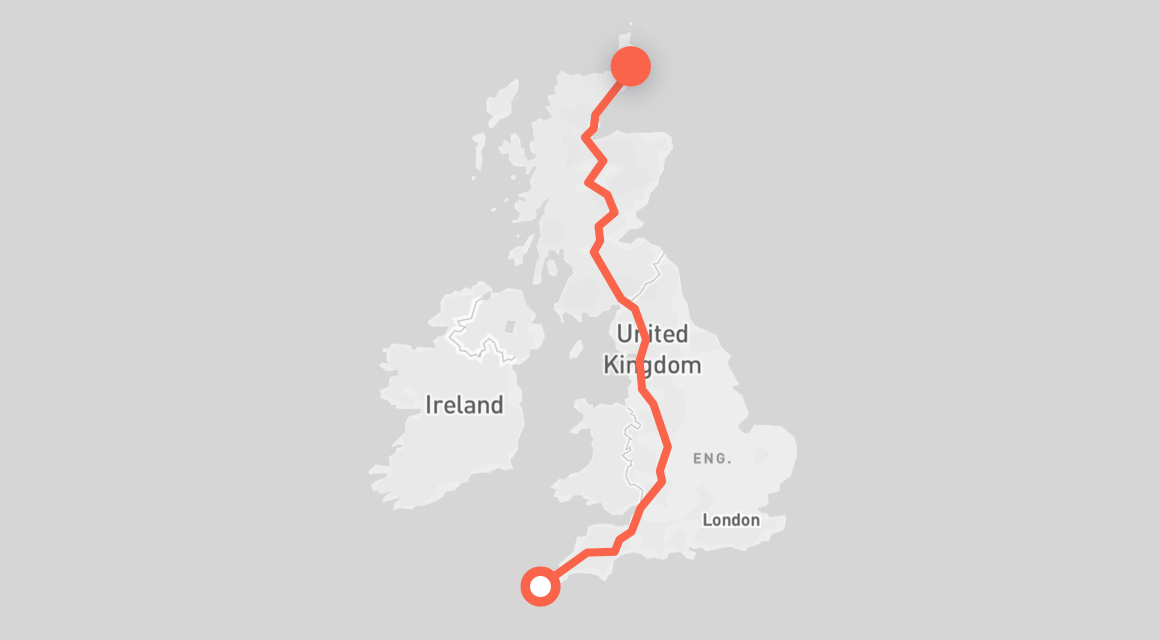

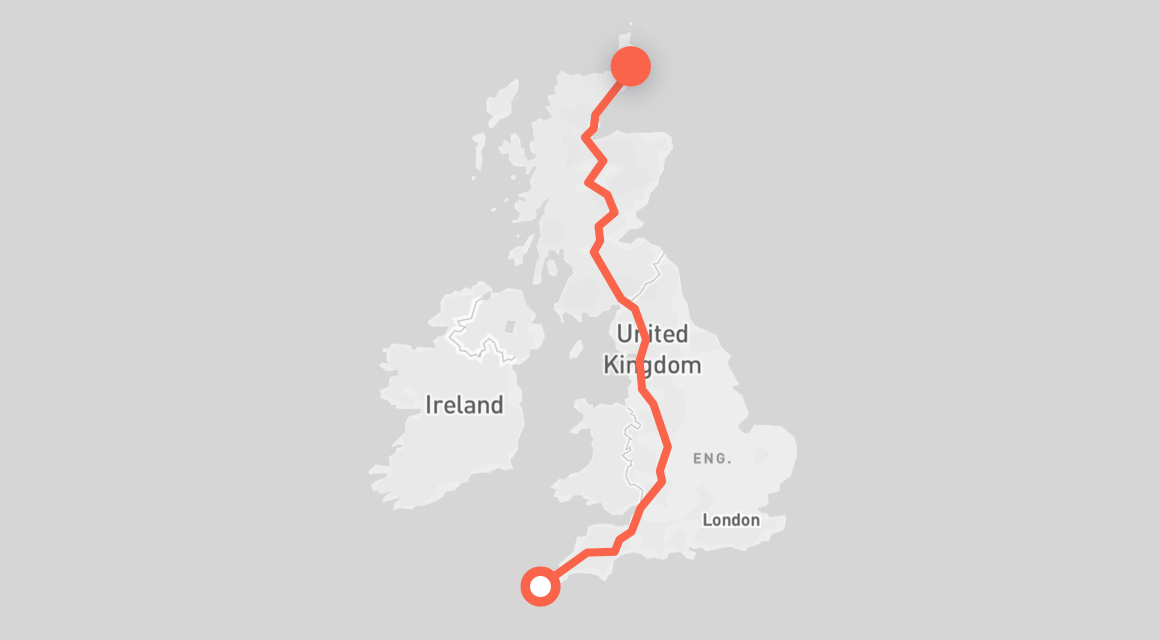

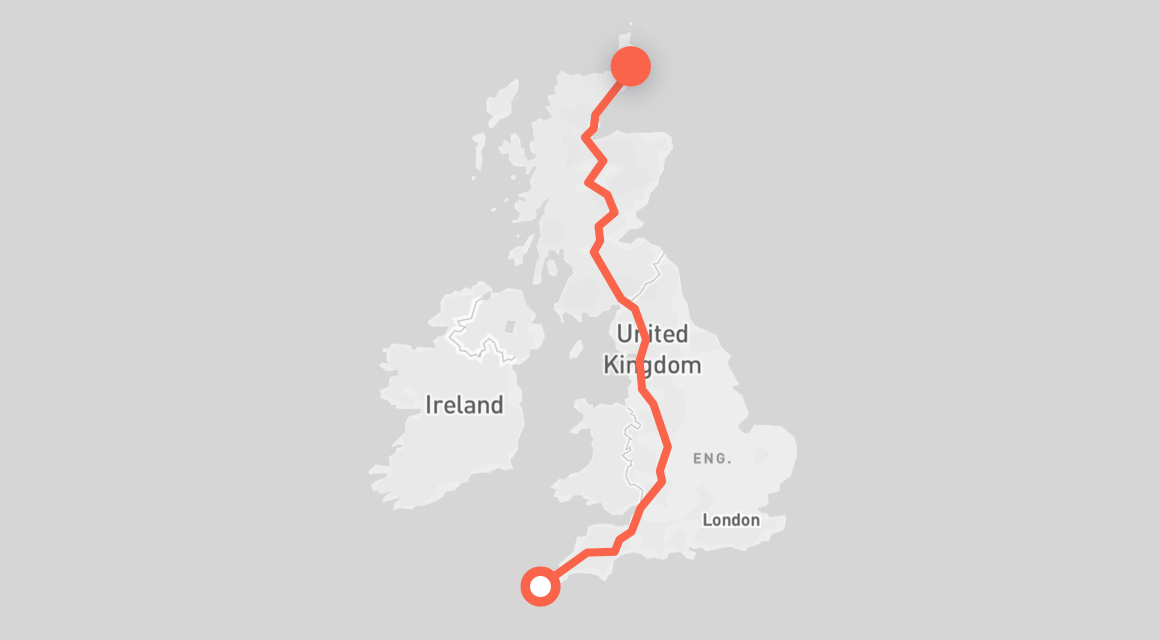

You’ll be pleased to know that we do offer coverage for those summer holiday road trips.

You get the exact same cover as you do in the UK while you’re abroad in any European Union country, as well as Iceland, Liechtenstein, Norway and Switzerland, for up to 90 days in any one 12-month period. After that, you’ll only get the minimum compulsory insurance as required by EU law.

DLYCOP LOGIN

Defaqto is a well-known independent financial company specialising in scoring insurance products on the coverage they offer, and they gave our policies their second highest rating. That means the people at Defaqto think a By Miles policy offers good quality cover and a broad range of benefits. We’d tend to agree.

We’re rated ‘Excellent’ on Trustpilot too.

MY SHIBA ACADEMIA APP

By Miles is a ‘telematics’ car insurance policy, which means it uses data from your driving to help price your insurance. Sometimes people call that black box insurance. But By Miles works very differently to most other black box insurance policies out there.

Depending on the make and model of your car, we’ll count the number of miles you drive in one of two ways. The first option is using something called a Miles Tracker which you plug into your car. The second option (if you have a newer car) is that we go totally trackerless and take the information direct from your car’s mileometer.

Our Miles Tracker is a little black box the size of a matchbox. We use it to calculate how many miles you drive and work out the cost of each journey.

If you’ve got a trackerless policy, you just give your car’s manufacturer permission to start sending information about your mileage to us automatically. No need to plug anything in at all.

Our policies are different to many “black box” insurance policies out there.

- Our policies are “pay as you drive” and not “pay how you drive”. That means we don’t use the way you drive to price your premium, just the distance you drive.

- Unlike the bulky black box devices offered by other insurers, you don’t need to get an engineer to come and fit our Miles Tracker. You can quickly plug it into your car yourself. If your car works with our trackerless policy, you don’t need any hardware at all!

- The Miles Tracker offers more than just the chance to get cheaper auto insurance. As well as helping you track your car’s location with Find My Car, it can read your car’s warning lights and engine codes which our Car Medic translates into plain English for you.

- You can access all your own driving data in our smartphone app to help you take control of the cost of your car insurance. For more information on the data we collect, please read our privacy policy.

GASGAINS EXCHANGE

It entirely depends on whether or not you’ve got a compatible car. You can find out if your car is compatible by getting a quick quote with your registration number. If your car’s make and model is compatible, you’ll see a toggle that allows you to switch between a Miles Tracker and trackerless policy.

If you’ve already got a compatible car and are using a Miles Tracker with us at the moment, just get in touch with us using the live chat in your app, or by calling 0330 088 3838. We’ll be able to get you switched over.

NODESTATS 交易所

When you buy a motor insurance policy from us, we’ll send you a Miles Tracker. It’s a telematics (or black box) device about the size of a matchbox that plugs into your car.

In order for us to offer you fairer, smarter car insurance, you need to plug this little box into your car’s OBD-II socket (this stands for On Board Diagnostics), also known as an OBD port. We’ll give you full instructions for your car when you buy a policy.

Once it’s plugged in for the first time, the Miles Tracker will automatically activate. Plugging in should only take a few minutes, but we’ll always be on hand to help if you find it a bit tricky.

Don’t unplug the Miles Tracker after this, as we need it to accurately measure your journeys so we can calculate your insurance premiums.

If you unplug the tracker, we’ll charge you the maximum daily rate of 150 miles at your per-mile rate until it’s plugged back in, and we may cancel your policy.

Our little black box can’t always communicate with us in real-time if you have low GPS signal, but it will keep tracking your journey in the background. If you’re in an underground car park or you’re driving in an area of outstanding natural beauty and there’s no signal or reception, it might take a little while to find signal again, but when you do the journey will show up in your app.

FRIDGE TOKEN 交易所

When you get a quote from us, we’ll check your car is compatible with our Miles Tracker. All cars made after 2002 will have an OBD-II socket, but some might be harder to find than others.

The OBD-II socket is normally found under your car’s dashboard, generally within 2 feet of your steering wheel. Depending on your car’s make and model, it might be hidden behind a panel or in a drawer.

Once you’re a By Miles member, if you download the By Miles smartphone app or log into our web dashboard, you’ll see full instructions for your car about where the black box plugs in.

If you still can’t find your car’s OBD port or you’re struggling to plug in, you can contact us via live chat in the app, or get in touch with our activations team at a-team@bymiles.co.uk. If your OBD-II socket is in an awkward location, we can send you a free extension cable so you can put the Miles Tracker in a more convenient place.

PIXEL CANVAS EXCHANGE

By Miles car insurance policies are all about the miles you drive, and we either use your car’s mileometer readings or use our Miles Tracker telematics device to measure the miles you drive. It’s important to note that we price your car insurance premiums on how far you drive, not how well.

While we’d always encourage motorists to drive safely, responsibly and within the speed limit, we don’t change your premium based on the way you drive, where you drive, when you drive, or the speed you drive at. We only use the information you give us when you start your policy and the miles you travel to work out your car insurance premiums.

Your driving data is safe and secure with us, too. We use information from you connected car or the Miles Tracker to manage your insurance policy and better understand how and when accidents occur, but we’ll never share it with anyone else without your permission. We’ll never share any information about your driving with the police either, unless we’re specifically asked to as a result of a court order.

For more information on the data we collect from your car or with our Miles Tracker and what we do with it, you’ll want to read our privacy policy.

CRYPTO CASINO INSTANT WITHDRAWAL

Not at all. We built the By Miles smartphone app to offer you a range of handy driving tools and help you easily keep track of your journeys so you can see how many miles you’ve driven and the cost of each trip.

At the same time though, you don’t need to use our car insurance app to be insured.

If you don’t have a smartphone, you can use our web dashboard instead — and if you don’t want to use the app or website, that’s fine too.

Whether you’re using a Miles Tracker or you’re on a trackerless policy, we measure your mileage automatically and it works totally independently of the app and website. We email you a monthly statement to let you know how much you’ve spent anyway.

MEDIUMCHAIN LOGIN

Our user-friendly smartphone app offers more than just your journey history. We’ve added a range of free tools and reminders that can help you save time and money, including:

Find my car – Use the app to help find your car if you’ve forgotten where you’ve parked in a massive airport car park (if your car is stolen, it can help us track it down too)

Car medic – If you’ve got a warning light on your dashboard, you can use the app to scan your car for codes related to the engine, battery or other mechanical issues. Car medic helps to translate your engine codes into plain English.

Handy reminders – Get reminders for your MOT or car tax from our team, with automatic reminders soon to arrive in the app.

Journey estimate and petrol calculator – Work out the likely cost of your motor insurance for a journey before you drive it, and calculate the cost of petrol for the trip too.

Please note: Depending on whether you’re on a trackerless or Miles Tracker policy, we can’t always offer all of the tools above – it totally depends on the make and model of your car.

TOAD KILLER LOGIN

Click here for a free, no obligation quick quote. We like to think we’ve made it as easy as we possibly can. Just answer a few simple questions and we’ll give you an instant estimate for a pay-per-mile policy.

If the numbers look like they’ll work for you, you can go ahead and get a full quote in a matter of minutes. Don’t forget to enter your information accurately and honestly or the quote you see might not be valid.

HYPERBC TOKEN APP

Yes. With By Miles every policy you have fully comp cover at all times. That means when you take out a policy, and subject to any excess, you’ll get cover included for:

- Your car, which is covered against accidents, vandalism, fire or theft

- Your car’s contents, which are also covered against accidents, vandalism, fire or theft

- Damage to your car’s windscreen

- Medical costs following an accident

- Injury to any passengers or any damage to any property in your car

- Driving in certain countries outside of the UK (though we should tell you that this cover is pretty basic)

PYTH NETWORK 交易所

With By Miles, you pay your premiums for your driving on a monthly basis.

However, at the start of your annual policy, you still need to pay an upfront fee for the year to cover your car while it’s parked.

At the moment we don’t offer the option of paying the annual fee on a monthly basis, as we’re not keen on adding hefty interest payments like many other insurers do.

After you start your policy, you just pay monthly premiums, based only on the number of miles you’ve driven. So if you don’t drive, you won’t pay a penny more — a bit like a pay-as-you-go phone bill.